Giving FRE students a head start

Tandon’s Department of Finance and Risk Engineering offers a one-of-a-kind boot camp

Students participating in a unique two-week summer program aimed to ensure that they quickly develop a strong foundation to prepare them for the Master's program in Finance and Risk Engineering

Graduate students joining the Finance and Risk Engineering (FRE) Department at NYU Tandon join not only one of the most competitive quant programs in the world, but also one of the most competitive industries. A unique Pre-Graduate Program Boot Camp aims to make Tandon’s newest students far more than competitive as they begin their studies in the city’s iconic financial capital.

The intensive course of study is particularly valuable since Master’s students arrive at FRE with a wide variety of undergraduate backgrounds and must quickly develop a strong intellectual foundation in such areas as basic finance, linear algebra, probability and statistics, advanced calculus, and computer programming.

The two-week in-person summer boot camp is unlike any offered by other engineering departments and aims to ensure that students can quickly meet their maximum academic potential at Tandon. This year, the group arrived on August 5 to embark on a vast overview of topics. The morning session includes topics such as series summations and math inductions; probability and statistics; Markov chains; martingales and random walks; and stochastic calculus and options pricing. All of these topics are covered with an emphasis on solving problems that are typically asked in quant interviews. The afternoon boot camp session covers topics such as Python and NumPy; Pandas; introduction to Econometrics with Python; and introduction to Machine Learning with Python — all areas of expertise among the department’s deep bench of faculty members.

The in-person boot camp — overseen this year by Assistant Professor Andrew Papanicolaou and Visiting Professor Conall O’Sullivan — is mandatory for all incoming students, many of whom have also completed an optional six-week online boot camp in June and July.

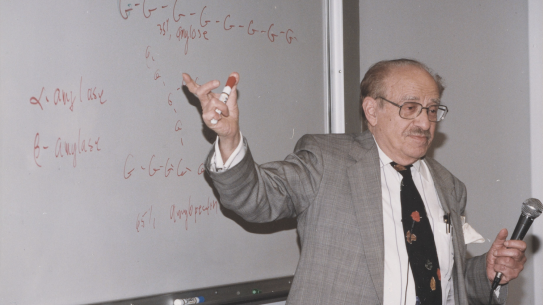

The online boot camp, which was first introduced as a trial run in Summer 2017, was taught by Industry Full Professor David Shimko, an industry veteran, and focused on capital markets; advanced calculus; linear algebra; Python programming; and probability, statistics and risk management.

In addition to preparing students for their studies, the FRE boot camp also prepares students for internships and entry into the professional world — a vital element considering that the top financial firms begin recruiting at the start of the fall semester for quantitative summer internships.

The incoming cohort is provided with a granular perspective on what industry employers are looking for, how they can best prepare, and the broad range of topics they might be asked during an interview; from mathematical brain teasers to technical programming questions involving machine learning and artificial intelligence. Throughout the internship screening process, students may also be asked to take written exams with questions on stochastic calculus, Black-Scholes pricing theory, or Python coding, and while it's a lot to master by interview season — the boot camp provides students with a deeper understanding of the cornucopia of topics important to the modern financial services industry.